ATTENTION: FIRST HOME BUYERS

Make The Move From Dreaming To Owning - We'll Guide You Every Step Of The Way

Buying Your First Home Or Investment Property? You're in the Right Place.

CLICK BELOW TO WATCH FIRST!

Taking the first step toward home ownership can feel overwhelming, but it doesn’t have to be.

We help first home buyers like you understand your options, get prepared, and buy with confidence.

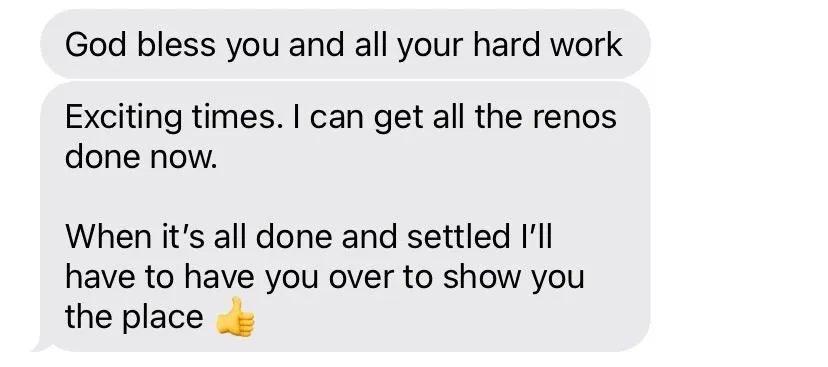

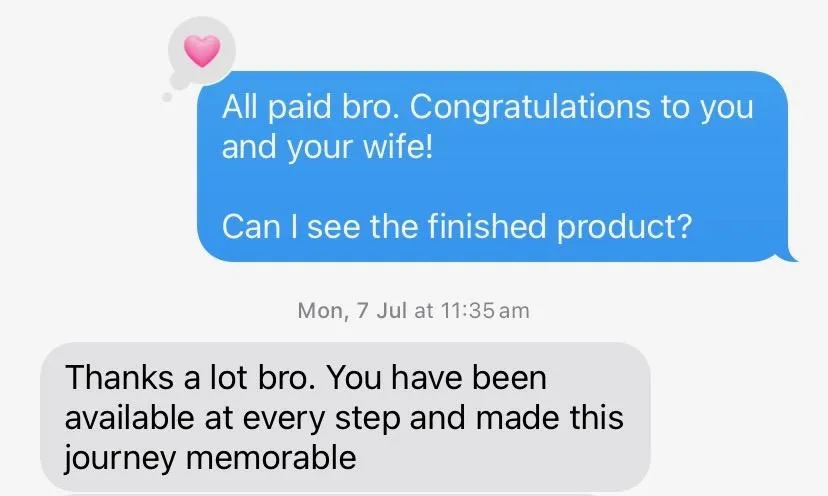

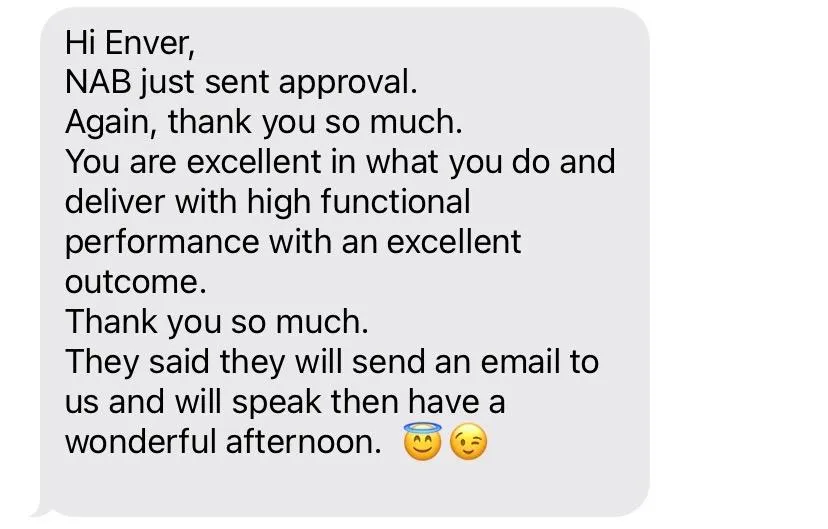

TESTIMONIALS

Heres What Others Have To Say.

Why First Home Buyers and First Time Investors choose us

EXPERT GUIDANCE

personalized plan

TAILORED PRE APPROVAL

ACCESS TO MULTIPLE LENDERS

PROVEN TRACK RECORD

ACCESS TO LOWER DEPOSIT HOME LOANS

STILL NOT SURE?

Frequently Asked Questions

Here's what we usually get asked

How much do your services cost?

Mortgage Brokers act as a middle man for their clients and do not charge a fee. Their services are completely free. Once your loan is approved and settles, the bank will compensate the mortgage broker for their time. The total cost to the borrower for our services is $0. You won't pay anything.

Do you tailor the finance options to client needs?

We believe that one size does not fit all when it comes to home loans. That's why we offer tailored mortgage solutions designed to meet your unique needs. By assessing your financial situation, credit history, and plans to purchase property, we identify the best loan products and terms for you. Our extensive network of over 40 lenders ensures that we can find competitive rates and favourable terms that suit your specific circumstances.

Do you help people that need a lot of assistance?

From the initial consultation to the moment you get the keys to your new home, we are with you every step of the way. Our brokers are always available to answer your questions, address your concerns, and provide expert advice. We are committed to ensuring that your home-buying journey is enjoyable and successful. We Will Make it Simple!

Can you help with Investment Property Purchases?

For those looking to invest in real estate, we offer tailored financing solutions that align with your investment strategy. Our team provides insights into market trends and helps structure loans to optimise cash flow and tax benefits.

Do you have options for more bespoke finance options?

We understand that some clients have unique financing needs. Whether it's a Bridging Loan, a loan for your renovations, or a parental leave loan, we offer specialty loan products designed to meet your specific requirements.

Is the loan application process complicated?

Buying a home involves a lot of paperwork which can be overwhelming. Our team handles all the details, from pre-approval to settlement, to make the process as seamless as possible. We assist with document preparation, speak to all the lenders, and provide regular updates to keep you informed and stress-free.

How We Get Your Home Loan Approved

Initial Phone Call

We will chat over the phone or via ZOOM for 15-20 minutes to ensure we're setting you up for success!

Tailor A Solution

We will do ALL the work for you, from application to settlement and you won't have to pay a CENT, we get paid by the banks!

Approve Your Loan

We will get your loan approved, help you on your property journey and make sure you move in confidently and comfortable into your new home!

Ready to get started?

MEET THE DIRECTOR

Hey, I'm Enver

I help home owners find the best possible deal, structure their loans correctly so they don't have to lose their minds at tax time and make sure they're keeping their bank honest so you're saving the most money possible.

Reached Diamond Lender Status TWICE at the Biggest Bank in Australia, then left to pursure even greater things!

Written over $300M in home loans over the past 9 years

2025 Winner - Best Mortgage Broker in Monash